In the midst of market volatility and economic uncertainty, it’s easy to lose sight of long-term financial goals. However, focusing on the bigger picture is essential for building and sustaining wealth over time. Albert Einstein is often attributed with the quote, “Compound interest is the eighth wonder of the world. He who understands it earns it; he who doesn’t pays it.”

This saying encapsulates the significance of compound interest in wealth accumulation, highlighting the importance of three critical factors: time, returns, and the amount you invest.

To fully grasp the profound impact of compounding on your financial journey, it’s essential to delve into how these elements interact and influence the growth of your investments over time. Let’s explore each factor in detail and understand why compounding is a financial wonder.

The Power of Time in Compounding

Warren Buffett, one of the most successful investors in history, often emphasises the value of time when investing. He has famously said, “The biggest thing about making money is time.” This simple yet profound statement underscores the importance of patience and the long-term perspective in wealth-building. To illustrate this concept, let’s consider a scenario where you invest =N=10,000,000 or its equivalent in Naira over various periods—180 days, 270 days, and 365 days—with an assumed rate of 10%.

After a year, your initial =N=10,000,000 investment would have grown to =N=11,000,000. This is only the beginning of what time can achieve. Extending the investment period to another 365 days with the same assumed interest rate of 10%, would increase your investment to =N=12,100,000. However, the true power of compounding becomes evident over a 5 year period, where your investment would have expanded to an impressive =N=16,105,000 — that’s approximately 162% increase of your original capital.

This example demonstrates the critical role that time plays in compounding. The longer your money remains invested, the more significant the growth due to compounding, exponentially increasing your returns as time progresses. This exponential growth occurs because compounding is not just earning returns on your original investment but also on the returns accumulated in previous periods. Over time, this effect becomes more pronounced, leading to substantial wealth accumulation.

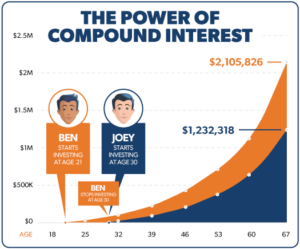

The sooner you start, the more you stand to gain, making time one of the most valuable assets in investing. Starting early allows you to take full advantage of the compounding effect, even if you can only invest small amounts initially. For instance, a young investor who begins investing in their 20s can achieve the same financial goals as someone who starts later but has to invest significantly more each year to catch up. This is why financial experts often advise starting as early as possible, even if the initial

The Impact of Returns on Compounding

The Impact of Returns on Compounding

While time is crucial, the rate of return on your investments is equally important in the compounding process. The higher your annual returns, the more rapidly your money will grow. To further illustrate this point, let’s revisit the scenario above, adjusting the annual returns to 20%.

With a 10% annual return, your =N=10,000,000 investment would grow to =N=11,000,000 after 365 days—a respectable increase but far less than the =N=12,000,000 you’d achieve with a 20% return. On the other hand, if you could secure a 20% return each year, your investment would skyrocket to =N=24,833,200 after 5 years, demonstrating the exponential effect of compounding at higher rates.

These figures underscore the importance of striving for higher returns, though it is important to acknowledge that achieving such rates consistently over the long term can be challenging. Even modest increases in your annual return can significantly impact your wealth accumulation over time, reinforcing the importance of wise investment choices and effective portfolio management.

AtSync Capital, we understand the critical role of strong returns from fixed-income investments in the compounding process. In line with our core objective, we are strategically positioned to provide valuable insights and access to investment platforms that guarantee competitive returns on investments for discerning investors.

Their fixed-income offerings are tailored to provide stability and regular income, making them ideal choices for investors looking to balance risk and reward. By investing we strive to deliver steady returns that can serve as the foundation for your short to long-term investment strategy.

The Significance of Your Investment Amount

The amount you invest is the final piece of the compounding puzzle, and it is here that the magic of consistent contributions becomes most apparent. Regularly investing additional sums can dramatically increase the value of your investment over time. For instance, let’s say you start with an initial investment of =N=10,000,000 and then contribute an additional =N5,000,000 at the beginning of each year, with an average return of 10% per annum.

If you contribute an extra =N=5,000,000 annually, your portfolio will grow to =N=46,630,600 after 5 years.

However, it is crucial to note that these calculations assume a steady 10% return each year, which does not reflect the reality of fluctuating markets. The truth is that your returns will vary from year to year due to market conditions, economic factors, and other variables.

The Importance of Consistency and Discipline

The true power of compounding lies in consistency and discipline. While chasing after high returns or attempting to time the market may be tempting, the most reliable way to build wealth is to stay the course. By making regular investments and allowing them to compound over time, you can harness the full potential of compounding and set yourself up for a secure and comfortable financial future.

Additionally, it is essential to remember that compounding works both ways. Just as it can significantly grow your wealth, it can also magnify losses if poor investment choices are made. Therefore, maintaining a disciplined approach to investing, focusing on long-term goals and prudent risk management, is essential to fully benefiting from the power of compounding.

Conclusion

Compounding is undeniably one of the most powerful tools available to investors. You can significantly grow your wealth over time by understanding and leveraging the factors of time, returns, and the amount you invest. Whether you are just starting out or already have an established portfolio, there is always time to take advantage of compounding.

AtSync Capital, we are committed to helping you achieve your financial goals by providing the tools, resources, and expert guidance needed to make the most of your investments. Our platform is designed to help you invest wisely and take full advantage of the power of compounding to grow your wealth over time.

So why wait? Start your investment journey withSync Capital & Advisory Limitedtoday and let the power of compounding work for you. Invest now, and set yourself on the path to financial freedom and a prosperous future.

Let’s get started.REGISTER NOW